This year, the Free Application for Federal Student Aid underwent significant changes due to the new FAFSA Simplification Act. The legislation aimed to simplify the financial aid application process for students and parents, but instead introduced a variety of glitches that led to widespread confusion and difficulties receiving aid.

The act was passed in December of 2020 and went into effect this academic aid year. According to the office of Federal Student Aid, the change “represents a significant overhaul” of their form processing.

Tara Torres, Associate Director of Scholarships and Strategic Initiatives at the University of North Florida, thinks that the overhaul is a necessary change for the notoriously lengthy application. She explained that the new system was built “from the ground up” and changed the way applicants and institutions report to the IRS.

Torres explained that the act is an effort to simplify the application process and increase the transparency of the complex application.

“[There are] less questions, [there are less] financial components,” Torres said.

However, the release of the new application was marred by a variety of technical issues. The FAFSA usually opens up on Oct. 1 each year, but complexities surrounding the new legislation pushed this year’s release to Dec. 31, 2023— the latest possible date to meet mandatory congressional timelines. According to Torres, this led to a rushed release of the new application.

“The technical ability was not ready yet,” Torres said.

The form had many issues from the start; delayed processing and the inability to correct previously-submitted applications were just two of many other difficulties. Torres mentioned that even now, batch corrections can’t be made as an institution.

According to Torres, these complications have prevented many students from receiving the aid they need which may cause students to forgo registration entirely.

“It’s impacting some folks that really may need some additional financial aid,” Torres said. “FAFSA completion rates are down, which could result in decreased enrollment.”

Due to the high cost of education in the U.S., access to financial aid is a major factor for students deciding to enroll in higher education. 87.3% of first-time, first-year undergraduate students receive some form of financial aid. An inability to complete the FAFSA form would mean many first-year students would miss out on some much-needed financial aid.

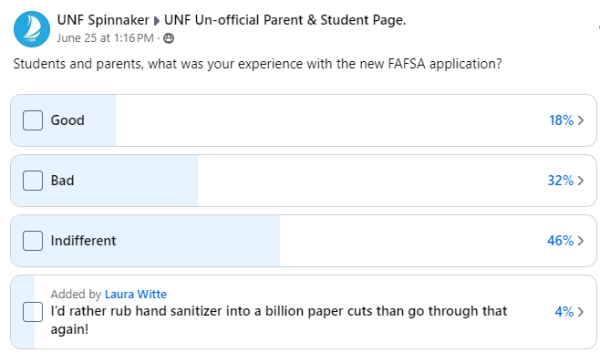

Spinnaker asked students and parents in June via Facebook poll about their thoughts on the new FAFSA form and received mixed responses. The plurality of respondents (46%) were “indifferent” while 32% reported that their experience was “bad.” 18% thought their experience was “good.”

Despite its rollout problems, Torres believes FAFSA’s changes will be positive for students.

“In the long run it will [be positive],” she said. “[It’s] a whole new system…[They’re] starting something from scratch.”

UNF students with questions about their financial aid can contact onestop@unf.edu. For an outline of key changes made by the FAFSA Simplification Act, visit unf.edu/financialaid/fafsa-changes

___

For more information or news tips, or if you see an error in this story or have any compliments or concerns, contact editor@unfspinnaker.com.