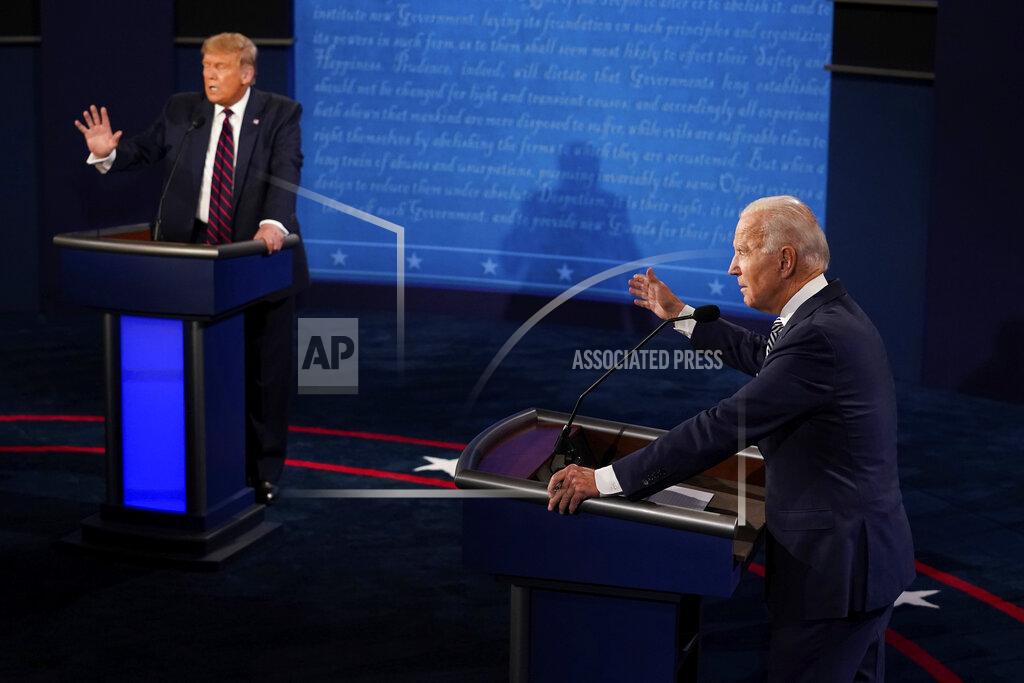

With the presidential election less than a month away, everyone is up in arms about which candidate they are going to support. All controversy aside, it’s important for Florida voters to remember that the ballots they’ll receive when they walk into the polls this November are asking their input on much more than who our nation’s next leader will be.

This voting season, Florida voters will find amendments one, two, three and five on the ballot, all of which could become implemented as state laws if passed. These are second degree amendments, meaning they modify existing amendments.

Here is a quick look at the amendments so that you can be ready when it comes time to vote on them:

Amendment 1: Florida Solar Energy Subsidies and Personal Solar Use

This amendment establishes a right under Florida’s constitution for consumers to own or lease solar equipment and to have them installed on their property for usage. It would also mandate that rates can not be increased for those who choose not to generate their own power.

Amendment 2: Florida Medical Marijuana Legalization

If amendment two passes it will legalize the use of medical marijuana. If passed, use of the drug would only be permitted if an individual has a debilitating diseases or comparable debilitating conditions determined by a licensed professional physician.

Amendment 3: Florida Tax Exemptions for Disabled First Responders

This amendment is for first responders who served and became totally and/or permanently disabled. This includes police officers, firefighters, the military etc. Passing amendment three would give them (or if deceased, their family members) property tax breaks and exemptions to help compensate for their losses.

Amendment 5: Florida property Tax Exemptions for Senior Citizens

Amendment five is a proposal to revise the homestead tax exemption on homes $250,000 or less. This does not apply to individuals who are under the age of 65 and haven’t lived in their home for more than 25 years, and could change many times by the time you reach this category. If you do meet the requirements, it could mean a fixed-rate tax exemption.

—

For more information or news tips, or if you see an error in this story or have any compliments or concerns, contact editor@unfspinnaker.com.

toblerone | Nov 3, 2016 at 9:11 am

and the missing one from this article:

County Referendum No. 1 on the Nov. 8 general election ballot asks whether pari-mutuel betting facilities in Duval County can install slot machines.

The FL Supreme Court may overthrow BUT–BestBet is BANKING on the stupidity of voters to think “they” will be the ONLY ones forcasting over 2000 jobs created?…How do you get 2000 jobs by adding 1500 slot machines…?…think…McFly…think.

Regardless, BESTBET is pushing forward with the referendum in the event of a favorable court ruling.

The Florida Supreme Court is weighing a case brought by Gretna Racing, a small horse track in rural Gadsden County. That pari-mutuel facility argued in June state law allows counties to put the question of slot machines to voters in the form of a local referendum, but the state claims only the Legislature can decide if and where they’re allowed.

The outcome will affect at least six counties where slot machines have already been approved. Seven, if Duval County voters say yes.

The state Supreme Court does not have a deadline to rule on the matter.

vote No…either way…more ways to lose your money is NOT a good thing.

toblerone | Nov 3, 2016 at 9:04 am

“If amendment two passes it will legalize the use of medical marijuana.”

yes but no….(Medical marijuana in pill form is already being produced and used in Florida)

http://www.wctv.tv/content/news/Tallahassee-marijuana-dispensary-will-be-first-in-Florida-to-open-387658471.html

This amendment is for the door opening for smoking…and allowing care givers access to “regulate”…

This amendment is very deceiving as well.

Vote No unless you are ready for over 200 pot shops to begin springing up in Florida.

Daniel Banks | Oct 23, 2016 at 2:21 pm

The ballot language on Amendment 1 is very misleading and wouldn’t expand solar energy at all. Vote No. http://www.tampabay.com/opinion/editorials/times-recommends-vote-no-on-anti-solar-amendment-1/2298106