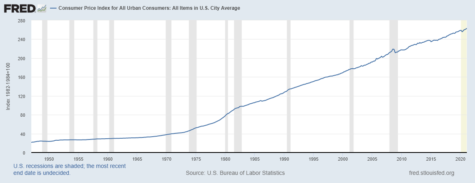

Inflation is an important concept for people to understand because it can affect a plethora of important areas that have to do with your finances. Simply put , inflation is defined as the upward movement in the overall price of goods and services in the economy.

Over time, inflation can cause a currency to devalue. When currency devalues, so does purchasing power. Thus, in turn, it takes more money to buy the same amount of goods and services than it might have been in the past. For example, in 1965 McDonald’s hamburgers sold for 15 cents. Because of inflation, they now sell for $1.00 to $1.50. When inflation occurs, your money buys you less of the product it previously could afford you.

Economists often list three main reasons for the cause of inflation: 1. demand-pull, 2. cost-push, and 3. money supply expansion.

In the demand-pull, consumer demand for goods and services is greater than the available supply, so the pricing of those items is raised to prevent inventories from being depleted.

In cost-push inflation, sellers raise their pricing in order to cover their increased production costs such as labor and components of the items they produce.

In money supply, the government helps to control inflation. As more money is in circulation, consumers will likely use it to purchase additional items they would not have normally bought.

Hyperinflation, on the other hand, is very high and typically accelerating inflation. It erodes the real value of the local currency at a faster rate as the prices of all goods increase. Hyperinflation usually has two main causes, which we previously covered: an increase in the money supply and demand-pull inflation.

A few factors that can lead to hyperinflation are high national debt, a decline in economic output, a decline in export earnings, price controls that exacerbate shortages, lack of confidence in government, and economy and political life.

An example of hyperinflation was exemplified by the crisis in Zimbabwe in the late 1990s. Essentially, the government started a series of land reforms that redistributed land from existing White farmers to Black farmers. New farmers struggled to produce food so there was a collapse in food production. The economy had a decline in output of goods and this caused a collapse in bank lending. In turn, the government printed money and increased the money supply in response to the issue. The government not only printed money to help with the economic crisis, but also to help afford the war that was going on in the Congo at the time. As the economy declined, the government debt increased. To help afford the extra debt, the government kept printing money which led to increased inflation. Because of this, the economy experienced many shortages of goods, and residents could barely afford basic necessities.

Whether you’re interested in economics or not, inflation and hyperinflation is an important concept for people to understand.

_____

For more information or news tips, or if you see an error in this story or have any compliments or concerns, contact editor@unfspinnaker.com.